A friend shared a couple of links with me recently about the Mulesoft IPO which is happening soon and it got me thinking about how this might affect us in the Microsoft integration world. First off those links:

- http://tomtunguz.com/mulesoft-s-1/

- https://www.sec.gov/Archives/edgar/data/1374684/000119312517047884/d287291ds1.htm

- http://www.cnbc.com/2017/03/06/mulesoft-ipo-test-public-markets-appetite-for-unicorns.html

It is really interesting to see a major move like this by one of the big iPaas players. Mulesoft is a company I have followed for some time, in particular during the years when Microsoft were making such a marketing disaster around their integration offering up until 2015. At that point Microsoft has lost their way in the integration space there was a point when there was a serious consideration about switching to focus on Mulesoft for my customers. The main driver for this wasn’t technical. It was all driven by the fact that Mulesoft made such a great marketing story and such a lot of noise in the industry that it was difficult not to want to follow it. At the time I held fire because I wanted to make a major bet on Microsoft Azure Cloud and I felt that the changes Microsoft were looking to make around their integration technologies would eventually pay off in the long run and the marketing as part of the Azure brand would fix the problems Microsoft were experiencing pre-2015. The fixing of this service can help with bringing in more subscription services as customers flock to see which changes have been implemented and what can work for them. It may be best to then update their subscription services and manage them in a better way so that there is less chance of fallout. Companies who are also experiencing related needs like this can find more info at websites such as fastspring.com for an update to their services.

If we take a look at some of the interesting points from the Mulesoft articles however we notice that:

- Mulesoft is growing at 70%

- Subscription recenue is at $150m per year

- Professional Services is $35 per year

- Their growth looks to have dropped off slightly in 2016 compared to 2015

- They now have 1071 customers (I assume this is subscription paying customers)

- New customer value nearly doubled from $77k to $169k (assume per year)

- Mulesoft is expected to go public at something north of $1.5 billion

The interesting bit between those articles which is a bit of a conflict is the first one suggests that Mulesoft is “rapidly approaching cashflow from operations breakeven and net income profitability” where as the article from CNBC suggests that Mulesoft “lost $50million of $188 million in revenue in 2016 and $65 million in 2015”. Im not sure which is right but lets assume its somewhere in the middle.

On paper Mulesoft would seem to be an interesting investment for customers and investors however I feel there are a few threats to Mulesoft which will make the future from the current industry positioning and the various things Microsoft are doing which would make an interesting discussion.

Threat 1 – Pricing Model

I think one thing has been missed however in the analysis and that is how the iPaaS landscape is starting to change. A similar thing happened with API Management (APIM) a couple of years ago. If you think back to 2013-2015 people were going crazy about API Management and it was viewed as a premium service which companies were paying 100K+ per year for a proxy in front of their API which offered added value features. The problem was that those APIM vendors were typically niche vendors who only did APIM. Eventually along came Microsoft and Amazon who offered APIM as a commodity service. They didn’t need to charge a high premium because if you use their APIM then you are likely to be using many of their other services too. This cross sell ability of the big cloud players meant you could now get APIM for 5 times cheaper in some cases. You might sacrifice some nice to have features but the core capability was there. If we now compare this with the iPaaS world. If you compare this to the iPaaS world today and look at some of the main players on Gartner or Forrester you will see a similar pattern in their pricing models. The pricing is often quite vague with things like “per connection” or “for N connections” with no real definition of what a connection is. Some examples are below:

- Snap Logic – 10k per month – https://www.snaplogic.com/snaplogic-editions

- Jitterbit – 2k – 6k or more per month – https://www.jitterbit.com/platform/pricing/

- Mulesoft – Pricing not publically listed – https://www.mulesoft.com/anypoint-pricing

- Dell Boomi – 2k to 8k or more per month – https://www.getapp.com/it-management-software/a/dell-boomi/pricing/

In all of these cases the pricing model boils down to having to contact the vendor and get their sales team involved before you can start. Not very “cloudy” in my opinion.

If we now consider how iPaaS is changing from a premium offering to a commodity, in particular driven by Microsoft with their Logic Apps offering the pricing model has these key differences:

- The price is publically displayed

- The price is charged on a per action basis which is genuinely pay as you go rather than paid for by “Compute unit” which means that the customer is usually paying for a % more capacity than they need just like in the old om premise server capacity models

If we consider the typical new Mulesoft customer who is spending approximately 169,000 per year for Mulesoft compute units then the equivalent is on Logic Apps you would get in the region of 4,000,000,000 actions per year. I think I would consider the costing models of Logic Apps to be a proper per usage cost model vs a per compute unit cost model used by most of the other vendors and perhaps this is going to be the evolution of Generation 2 iPaaS as other vendors follow this trend moving to a more Serverless model.

While Mulesoft has been in a great position for the last couple of years and made great progress, I wonder if the public offering is coordinated to this new threat of Generation 2 iPaaS which is genuinely Serverless whereas Generation 1 may look like Platform as a Service but it is clearly tied to underlying server infrastructure which is abstracted from the end customer. I would guess from my playing around with the product that it would take a reasonably big re-architecture of their product to be able to support a similar cost model to Logic Apps in particular when Mulesoft seems to runs on AWS rather than its own cloud fabric.

Threat 2 – Cross Sell

Mulesoft has a limited set of products focused around the integration space. They cover:

- iPaaS

- API Management

- Connectors

- Message Queue

This is the core bits of most integration platforms and they state that when you need something they don’t do then you should use “best of breed”. This is a valid approach and one used for a long time by vendors, but when competing against the big cloud vendors who have other stuff on their cloud the question is do I want:

- Option A – Go to another vendor, start a whole procurement process, evaluate options and N months later I can start using another product

- Option B – Click 3 buttons and have the capability on the cloud im already using

I would argue that in todays world of agility and speed option B is much more popular than an IT procurement exercise.

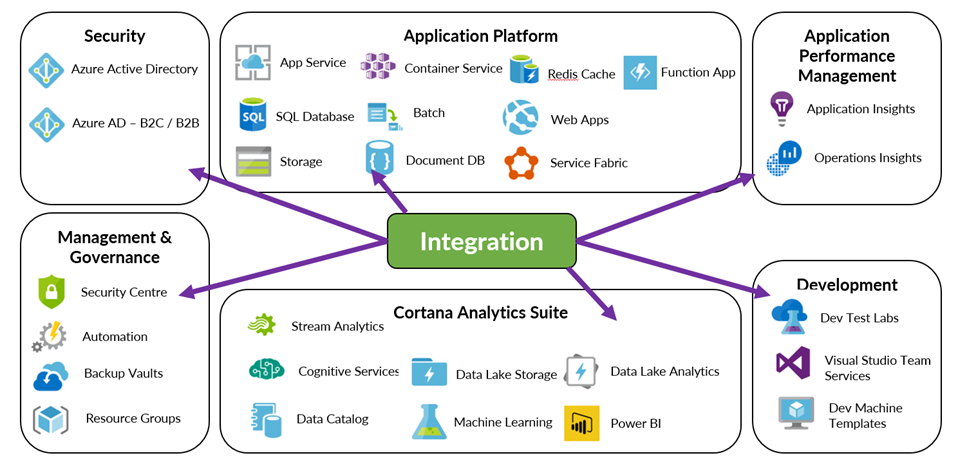

If we think about the Azure offering, the secret sauce to the Microsoft Integration platform is that you have the rest of the Azure cloud to use as illustrated below.

The key difference from this cross sell capability at the vendor is that companies like Amazon & Microsoft can make a platform play where they provide the platform for holistic solutions for the entire enterprise. This can be things such as classic infrastructure, through PaaS and to innovative stuff like machine learning, BOT frameworks, Big Data, Block Chain. Mulesoft is not in this platform level cloud game and can only offer a specialised niche around integration.

Thread 3 – Democratisation of Integration

One of the big themes in integration today is the democratization of integration. Two of the key elements within this are:

- Allowing the citizen integrator to be involved in the integration solutions the organisation uses

- Opening insights into the integration solutions your organisation has

In the first case, at present Mulesoft has no offering and no visibility of any offering that ive seen aimed at the Citizen Integrator. This is slightly strange as their marketing and blogging teams are usually all over big industry themes in integration but they seem to be giving this one a wide berth. The only stuff ive seen is forums which suggest teaching the citizen integrator to be a developer. If you compare this to the Microsoft offering where you have a very solid offering around Power Apps and Flow which are part of the integration suite but specifically aimed to empower the Citizen Integrator.

In the 2nd case analytics, insights and interesting stuff from your integration solutions is one of the best things about modern integration which can allow the business to get real added value from integration. Mulesoft has the analytics you would expect for their APIM offering and it also has a business events capability within the management console. While this ticks the basic boxes of reporting and insights it is lacking in the things the other major cloud vendors can offer. For example with Microsoft you have the ability to use Operations Manager Suite, Power BI, Cortana Analytics Suite, Application Insights all along side your integration solution to give you deep insights which can be targeted at different audiences such as an IT Pro or Business User or even a customer. The power to build a much richer solution is there.

Threat 4 – Target Customers

The fourth big threat is also associated with the pricing model. Mulesoft is only really relevant for big enterprise customers. They have 1000 of those but they are in a place where lots of established names such as Oracle, Tibco, Microsoft and various others already have major products with much higher customer numbers. EG: Microsoft BizTalk Server has 10,000+ customers. While Mulesoft may have made some inroads in winning customers by replacing their traditional integration platform, or more likely complimenting it with an iPaaS capability, this area is a competitive area. I said a few years ago at the Integrate conference that I felt the next big place for System Integrators would be with iPaaS products who could offer solutions for the SME companies. This is exactly where the Microsoft Logic Apps offering hits the nail on the head. With Azure an SME can setup a cloud scale, enterprise ready integration product and spend next to $0. They could build 1 simple interface to begin with and pay as they go. Over time its feasible they could grow significantly and just pay more as they use more. This opens up a world where Microsoft could conceivably have hundreds of thousands of SME customers using their iPaaS offering in a way none of the above vendors could compete with.

Its difficult to see how Mulesoft could compete in this space with their current cost model and its difficult to see how the cost model could change with the current product architecture.

Threat 5 – Questionable Innovation

If you look at the Mulesoft product offering over the last few years and consider how it has evolved, changed and how they have innovated then you could argue the answer is “not that much”. In the last couple of years the main new features are:

- A new mapper

- Anypoint MQ – JMS

- Monitoring

The reality is those 3 key areas are basic product capabilities required of ESB/iPaaS offerings so id hardly call that innovation.

Instead in the last couple of years Mulesoft have focused on getting as much return for the product they had through fantastic marketing and PR creating awareness in the industry. While they have lots of success you could argue that their ability to execute and completeness of vision has been overtaken by other vendors and also the integration world has been evolving.

In a post IPO world, is it likely that investment in R&D will see many new innovations when there will be drivers to reduce losses?

Threat 6 – Security Story

Following on from the innovation question, I also wonder about the positioning of Mulesofts product stack in terms of collaboration with security products that are out there, like the Seedboxescc alternatives for instance. If you consider the Microsoft world for a moment we see security in fundamental places like Azure Active Directory, Azure Active Directory B2C, Role Based Access Security, API Management security stories, multifactor authentication all giving Azure customers a fantastic hybrid security model covering the enterprise and customers. You then add to the mix Azure offerings such as Security Centre, Azure Advisor and Operations Manager Suite which all look at your solutions and tell you how they are doing against good practices, if there are any vulnerabilities and other good things like that.

The Integration Platform from Microsoft inherits all of this good stuff.

In the Mulesoft space, outside of the security used by its connectors to talk to an application there is a very limited security or governance story. I believe in the coming years this is one of the key areas customers will focus on much more when their cloud maturity increases.

Threat 7 – Post IPO Changes

I would suggest this is the biggest threat to Mulesoft, after an IPO many companies change in various ways. Some examples might include:

- Some of your good staff who were here for the IPO opportunity may move on to the next opportunity

- You now have to change from an attractive looking proposition to a business that makes a profit

- Its not so easy to go back to the industry for additional rounds of funding like Mulesoft have done a few times in recent years

I feel the biggest challenge is when the company now has to start being profitable. Well the challenge is that the customers you already have are paying a lot per customer for the services (based on what the articles above suggest) so its probably difficult to sell more compute to your existing customers. This leaves 2 avenues:

- Sell to more customers

- Reduce costs

Selling to more customers is going to be difficult, 3 years ago few people had heard of Mulesoft but today you see their ads everywhere and its hard to come across an organisation who hasn’t already heard of Mulesoft. Based on the numbers being mentioned in those articles, im not sure if even doubling their customer numbers from 1000 to 2000 would get them into regular profit. That’s before the fact that customers are becoming wiser to the challenge that iPaaS is not all about marketing blagware and buzz words and also realize that integration today doesn’t always need to be expensive.

This leaves reducing costs as a likely course of action and that means less noise and activity from Mulesoft.

Prediction

While I think it’s a great time to go public, I do wonder if the future for Mulesoft could be similar to what happened to APIGee when they went public (http://uk.businessinsider.com/why-google-spent-625-million-on-apigee-2016-11?r=US&IR=T). The problem is they are a niche company and cannot easily cross sell other services which they do as they don’t have the platform that the big cloud players have.

My prediction will be that as vendors need to move towards being a Generation 2 iPaaS vendor this is where Mulesoft will struggle. They have had major investment so far but will they need to rearchitect their core product to compete in the future? If you look at their products they have spent a lot of time over the last couple of years trying to bolt bits on so it to meet their sales commitment and lots of investment around sales, marketing and promotion, but there has been limited real product innovation in this time?

If Mulesoft have a similar journey to APIGee then one thing is for sure, Amazon and Google have not got much of an iPaaS offering so you could see an obvious acquisition target which would boost their cloud offerings. The only question around that however is with major investors like Salesforce, Cisco and Service Now you do wonder if that would be feasible.

From a Microsoft Integration persons perspective, all of this is fantastic news. Times have been tough for use for a few years competing with the marketing power of Mulesoft when Microsoft had up until recently been investing so little in marketing their integration stack and equally as little effort in selling it. Since that time though they now have a far superior integration suite and a genuine cloud platform offering which suits most customers. If Mulesoft turn out to have a bunch of internal challenges as result of the transition from private to public company then this will make life a lot simpler and perhaps my linked in ad’s will eventually stop spamming me with Mulesoft 10 times per day J

One thing is for sure it will certainly be interesting to watch the journey of Mulesoft in the public world and taking it to the next level and I wish them all the best.